16+ Balloon mortgage

See todays mortgage rates and get the best refinance mortgage rates or purchase mortgage rates by comparing mortgage rates for 30 year fixed 15 year fixed 51 ARMs and more. The choice of the method depends on the certainty of cash flows.

Ways To Pay Off Your Mortgage Early And Why We Did It

Noun a conveyance see conveyance 2a of or lien against property as for securing a loan that becomes void upon payment or performance according to stipulated terms.

. An agreement that allows you to borrow money from a bank or similar organization especially in. When a borrower is obligated on a non-mortgage debt - but is not the party who is actually repaying the debt - the lender may exclude the monthly payment from the borrowers recurring monthly obligations. The balloon loan calculator comes with an amortization schedule that shows each of your monthly payment and the final balloon payment.

Balloon Mortgage Calculator With Amortization Schedule excel is used to calculate monthly payment for your balloon mortgage. It was characterized by a rise in subprime mortgage delinquencies and foreclosures and the resulting decline of securities backed by said mortgages. Why a Balloon Loan.

Read unique story pieces columns written by editors and columnists at National Post. We can easily perform balloon payment calculations in Excel. Should I convert to a bi-weekly payment schedule.

Almost any data field on this form may be calculated. A balloon payment mortgage is a mortgage which does not fully amortize over the term of the note thus leaving a balance due at maturity. Balloon loans tend to be easier to qualify for.

Relevant portions of that table appear below. Given a balloon payment calculate constant payments. Should I rent or buy a home.

The ATRQM Rule also defines several categories of qualified mortgage loans which obtain certain protections from liability. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007. The final payment is called a balloon payment because of its large size.

A balloon payment mortgage may have a fixed or a. Comparing mortgage terms ie. 15 20 30 year Should I pay discount points for A lower interest rate.

FlexiSites is part of Future plc an international media group and leading digital publisher. Several major financial institutions collapsed in September 2008 with significant. Buying a home and expect to move before balloon period ends or have resources to pay off.

Balloon loans typically come with lower. 1172 million PS4s were sold over the last decade vs. The loan may be offered at the lenders standard variable ratebase rateThere may be a direct and legally defined link to the underlying.

What are the tax savings generated by my mortgage. While the amortization schedule will show you every payment over the term many people move or refinance their mortgage before paying off the loan. For home loans they usually come in short terms of 5 to 10 years.

Balloon loans with short terms are considered high-risk to lenders. There are two ways of going about the calculation. Compare a no-cost versus traditional mortgage.

5780 4810 4330 0609. Given a constant payment calculate the balloon payment. Just 585 million Xbox consoles NextTV.

By Daniel Frankel published 16 August 22. Only 16 families left before Mondays deadline for the Neighbors 4 Neighbors Adopt A Family for the Holidays program. The loan is secured on the borrowers property through a process.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. Balloon payments are a loan feature frequently found in commercial and residential mortgages.

The mortgage calculator also produces a table that shows the components of total mortgage cost for this fixed-rate balloon loan. Check out the latest breaking news videos and viral videos covering showbiz sport fashion technology and more from the Daily Mail and Mail on Sunday. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Calculate loan payment payoff time balloon interest rate even negative amortizations. Fixed or adjustable-rate. 5230 4380 4120 Source.

The primary reasons you might consider choosing a balloon loan over a conventional loan are because. Streaming app developers take note. But for buildings with significant wear and tear or properties over 30 years old they may only grant a commercial loan for 20 years.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Calculating the Balloon Payment. Home loans are often fully amortized loans with either a 15- or 30-year mortgage term.

A commercial mortgage is referred to as a permanent loan when you secure your first mortgage on a commercial property. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Here youll find the best how-to videos around from delicious easy-to-follow recipes to beauty and fashion tips.

Dec 12 2021 More Than 2000 Raised So Far For Family Burned Out Of Miami Home. Meanwhile commercial real estate loans can be as short as 1 year to 3 years while others can be 10 years. A variable-rate mortgage adjustable-rate mortgage ARM or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets.

Balloon-payment and interest-only mortgages. Subsequent widespread abuses of predatory lending occurred with the use of adjustable-rate mortgages. Subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007.

Personal loans are typically amortized for 25 years. Then after the 3-year pre-balloon period is up the balance of the loan must either be paid off or converted into another loan. Balloon payment mortgages are more common in commercial real estate than in residential real estate.

On December 16 2008 the Federal Reserve cut. With an adjustable-rate mortgage your loan may be automatically recast every time the interest rate changes. The Ability-to-RepayQualified Mortgage Rule ATRQM Rule requires a creditor to make a reasonable good faith determination of a consumers ability to repay a residential mortgage loan according to its terms.

Brets mortgageloan amortization schedule calculator. Get in-depth analysis on current news happenings and headlines.

What Is A Balloon Mortgage Pretty Great Until It Goes Bust Mortgage Payment Calculator Mortgage Payment Refinance Mortgage

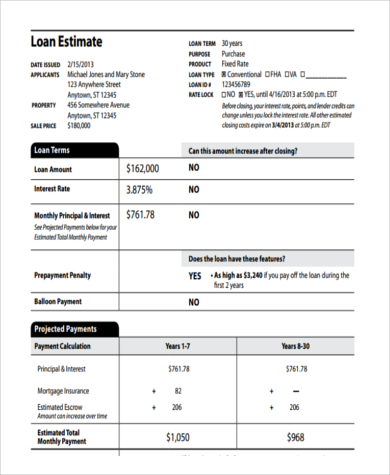

Free 7 Sample Loan Estimate Forms In Pdf Ms Word

Ways To Pay Off Your Mortgage Early And Why We Did It

Balloon Mortgage Write On Sticky Notes Isolated On Wooden Table Stock Photo Image Of Design Home 237407560 In 2022 Wooden Tables Sticky Notes Balloons

Balloon Loan Calculator For Excel

Zaily Knight Mortgage Loan Officer Vanderbilt Mortgage And Finance Inc Linkedin

16 Promissory Note Template Word Free Sample Example Format Free Premium Templates

Ways To Pay Off Your Mortgage Early And Why We Did It

Note Template 212 Free Word Excel Pdf Psd Eps Format Download Free Premium Templates

Balloon Mortgage Pros And Cons Should You Go For It The Smart Investor Mortgage Mortgage Marketing Mortgage Quotes

167 Note Templates Free Sample Example Pdf Psd Eps Format Download Free Premium Templates

Invest In Private Hard Money Loans

Free 7 Sample Loan Estimate Forms In Pdf Ms Word

Daddy Pop Balloons Daddypopballoons Posted On Instagram Happy Anniversary To My Mortgage Matters If You Are Local T Happy Anniversary Balloons Instagram

Free 7 Sample Loan Estimate Forms In Pdf Ms Word

Pulte Mortgage Review 2022 Review By Good Financial Cents

Esl Mortgage Rates Review By Good Financial Cents