39+ can you still deduct mortgage interest

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

4 Ways To Calculate Mortgage Interest Wikihow

Web You cant deduct the principal the borrowed money youre paying back.

. 16 2017 you can deduct the mortgage interest paid on your first 1 million in. However higher limitations 1 million 500000 if married. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full. Web For tax years 2018 to 2025 the standard deduction has been increased to 12000 for singles and married filing separately. Web Youre entitled to deduct only the mortgage interest that you personally paid regardless of who received the Form 1098 from the lender.

Web The answer is that you can only claim the deduction for the interest you actually paid. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. If your home was purchased before Dec.

Web One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage debt you can have before your interest is no longer fully deductible. You must also have a. 445 31 votes.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtednessHowever higher. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web Mortgage interest is currently tax deductible up to the total amount of interest paid in any given year on the first 750000 of your mortgage or 375000 if.

Web You can include the interest for that amount as a SCH E mortgage interest deduction. Just be aware that tracing rules apply and if audited you will have to. In addition to itemizing these conditions must be met for mortgage interest to be deductible.

Web If your home was purchased before Dec. Web Mortgage interest deduction limit. So if each person paid 50 of the mortgage each person is only eligible.

18000 for heads of household. Web You can still claim the mortgage interest deduction but due to the lowering of limits and the changing of the criteria it will rarely be worth it for most Americans. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

India Herald 030216 By India Herald Issuu

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Business Succession Planning And Exit Strategies For The Closely Held

Property In Chennai Apartments Flats Houses Offices For Sale In Christudas Hospital Tambaram East Chennai Justdial Real Estate

Mortgage Interest Deduction How It Calculate Tax Savings

What Happens To Your Bills When You Go To Jail In The Uk

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Mortgage Interest Deduction Rules Limits For 2023

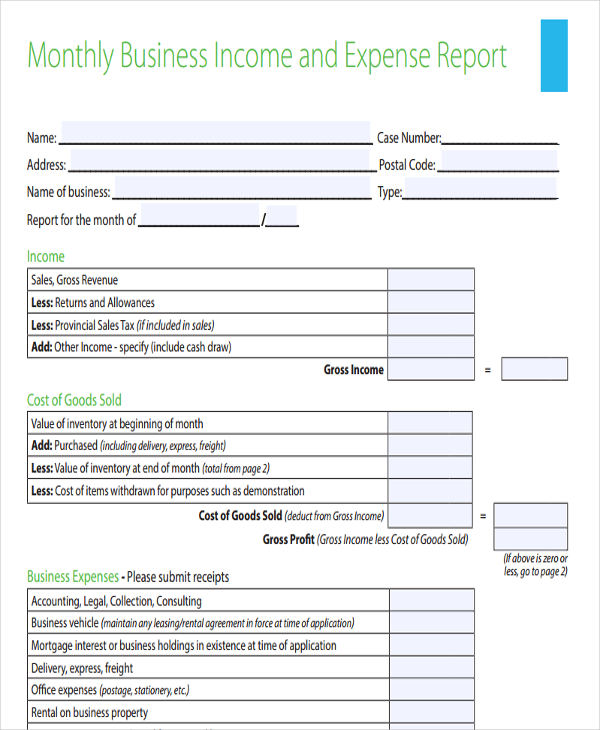

49 Monthly Report Format Templates Word Pdf Google Docs Apple Pages

Real Estate Issue 2022 By Montecito Journal Issuu

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service